Hospitals Pay Bills Through Predatory Tactics Against Their Patients

Monday July 19th, 2021

- The blame for patient debts is usually put on pharma companies who work to develop drugs in order to keep patients out of hosptials

- In reality, America’s top 10 hospitals hound patients with exorbitant bills in order to pay their own debts

- High markups, insurance deductibles and predatory billing are the real suspects

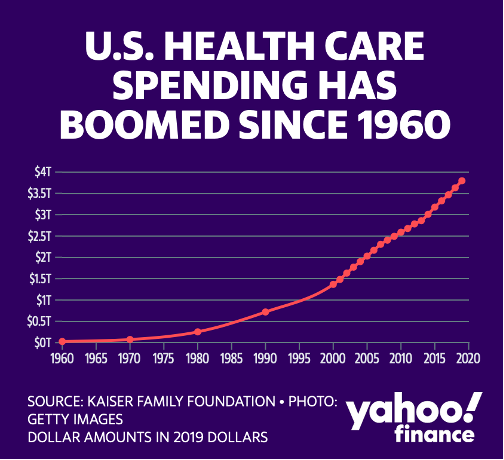

The number of Americans filing for bankruptcy continues to rise with medical debts being the #1 culprit. On average, debts burdening the lives of Americans range between $5,000 to $10,000 and total to $46 billion, yet healthcare costs in the country continue to rise.

The blame is usually put on pharma companies for exorbitant spending. The development of a pharmaceutical drug starting at the research and development stage all the way to market sales is in the billions of dollars. However, pharma companies work to develop drugs to keep patients out of hospitals. Where patients get hit with outrageous bills is at the hospitals.

These are 3 tactics hospitals use to charge patients higher prices and drive their own revenue:

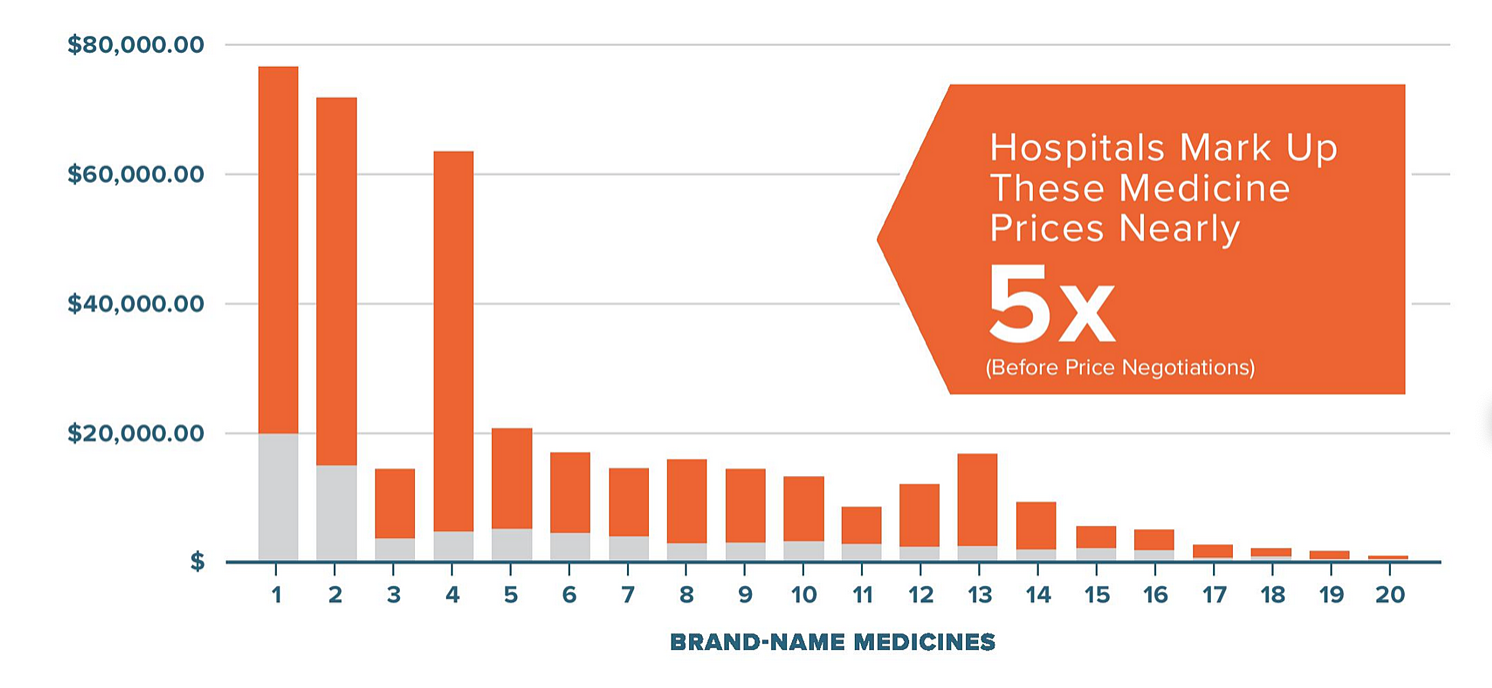

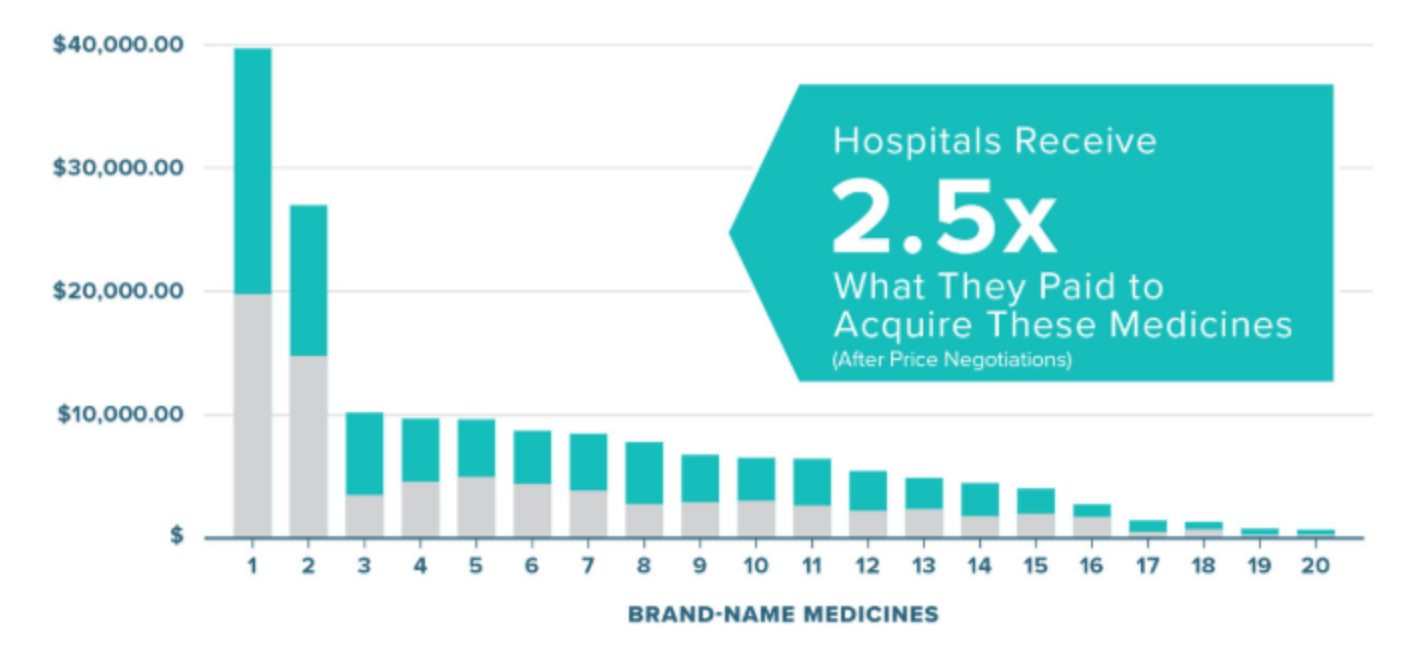

1. Drug Markups

Hospital drug markups are usually 5x the price and result in hospitals recieving 2.5x as much in revenue as what the pharma companies make. Seems a little strange when the pharma companies are the ones researching and developing the drugs while hospitals only administer.

Below is a visual representation of the mark-ups that hospitals place on select brand-name medicines. As seen, in most cases, the markup is at least double.

One study by John Hopkins University was looking at the top 100 hospitals in the US (by revenue) and found that on average, the costs of service were 7x higher than what it actual cost the hospital. Though industry officials claim that the mark-up in prices is just a way they negotiate with insurance companies, a study conducted in 2017 showed that for every dollar added to the list price, the hospital makes roughly an extra 20 cents. This is doubled on the high deductibles that insurance companies charge. In 2019, the average single deductible was nearly $2000 and the family deductible was over $3500.

2. Lawsuits

With medical costs increasing exponentially, patients (usually low-income) are left with no choice but to go into debt. Much of this healthcare debt cannot be paid by patients, who then face legal recourse.

The John Hopkins study found that 26 hospitals filed nearly 40,000 lawsuit against their patients. Costs totalled to more than $71 million, with three main hospitals accounting for more than three-quarters of this amount.

It is important to note that of these hospitals that are suing their patients, only one of them is for-profit while roughly two-thirds are non-profits. Seems a little ironic considering non-profits are exempt from paying taxes in exchange for free and affordable healthcare. And yet, patients are sued for nearly $2000, on average.

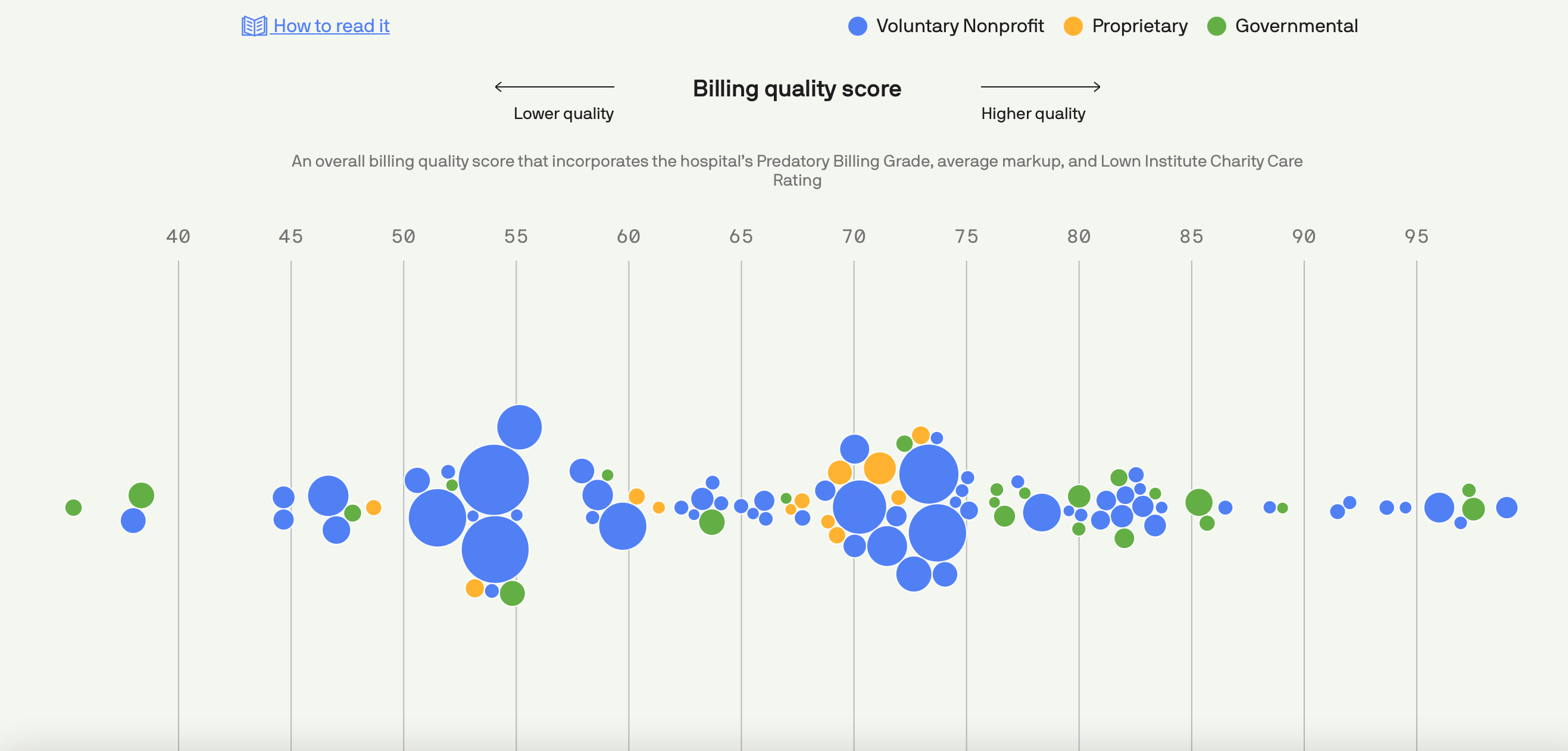

3. Predatory Billing

Millions of Americans are doomed by medical debt when they are charged for expenses they were unaware about, often referred to as “predatory billing”. This tactic is used by hospitals providing “in-network” health care provided by “out-of-network” health care providers.

Essentially, a patient can go to a health care facility that is included in their insurance network but get treated by a physician that is not in the network. All of this can take place without the patient knowing. This practice is different than balance billing, where the cost of care is not fully covered by the patient’s insurance plan.

This predatory tactic puts patients at financial risk unknowingly, especially since only 18 states are protected against such practices. A No Suprises Act bill was passed which is intended to protect patients against out-of-network costs, though not set to go into effect until January 2022.

Though lawsuits have decreased by 92% from 2018 to 2020 due to backlash against hospitals and a bill protecting against predatory practices is set to take place, patients are still suffering. Until 2022, Americans will be burdened with debt through predatory billing. Marked-up pricing and high insurance deductibles will continue to plague patients until the blame is shifted from pharma companies to hospitals and change is made.