Politicians Have It Wrong: Drug Pricing Is Not The Problem

Wednesday April 7th, 2021

- Politicians blame high healthcare costs on drug pricing when in reality hospitals are the biggest drivers.

- This fallacy was demonstrated in a presentation from Massachusetts healthcare claiming drug spending grew 7.2%. The more relevant figure showed drug spending grew only 3%.

- Policy makers are either playing their angle or are oblivious to the data.

- Drug pricing limits have been advocated, but this will only limit innovation.

Healthcare costs in the US are constantly debated and politicians often like to point the finger at pharmaceutical companies and high drug pricing. This article will take a deeper dive into the data and show that branded drugs from big pharma are a fraction of the problem. The biggest drivers of healthcare costs are hospitals, and they are evading political criticism. Instead of advocating for drug pricing limits, which will ultimately halt innovation and lead to higher long term healthcare costs, policy makers should focus on minimizing hospital expenditures and encourage competition in the sector.

Politicians Have Misdiagnosed the Problem

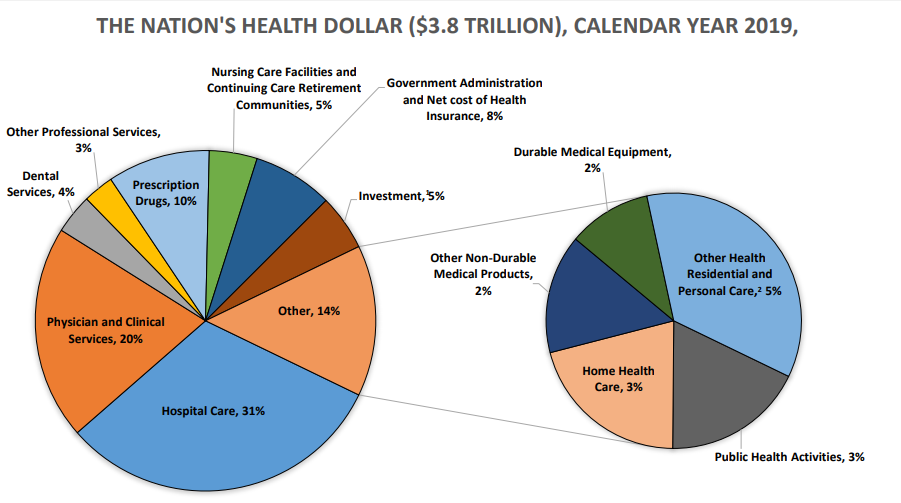

In 2019, the US spent $3.8T on healthcare, or about 20% of GDP. As seen below, the three largest components of healthcare spending, in order, are Hospital Care (31%), Physician/Clinical Services (20%) and Prescription Drugs (10%). Combined, these three categories make up over 60% of healthcare spending. Yet, politicians have smeared prescription drugs as the culprit, overlooking the LARGEST category: hospitals.

Figure 1:

There is also a false narrative that the price of prescription drugs has risen significantly in recent years. Sure, you may find headlines of absurd price hikes (such as Martin Shkrelli’s daraprim and others here). These examples, however, do not make the majority. They are the few cases that make the news. Reality is different.

A presentation given by the Massachusetts Health Policy Commission validates this fallacy by policy makers to overlook or blatantly misrepresent data.

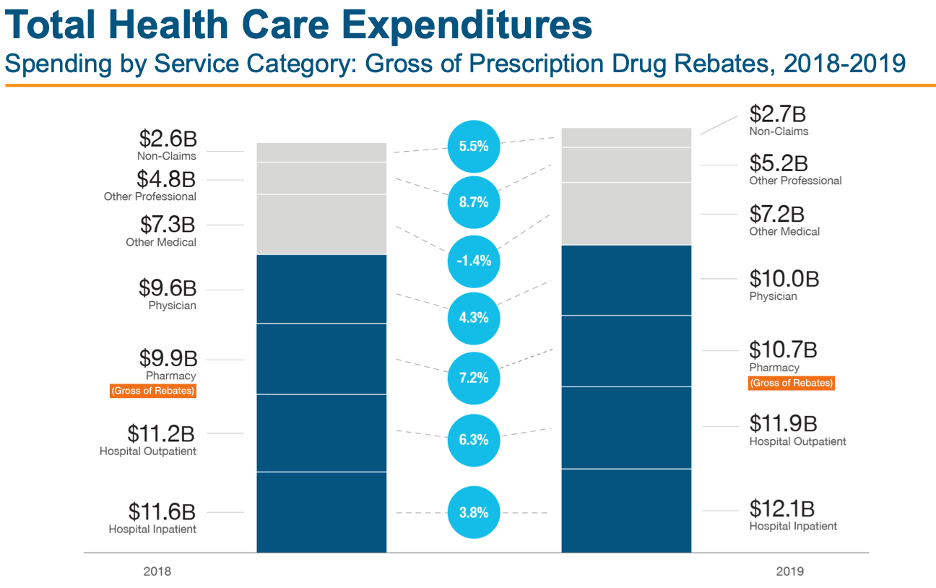

Perception: Prescription Drugs Grew 7.2%

The Massachusetts presentation reports that healthcare costs grew 4.3% to $64 billion in 2019. The “Pharmacy” category, represented by the gross prescription drug rebates, grew 7.2% to $10.7 billion. This was one of the fastest growing expenditures, according to the Massachusetts health commission.

Figure 2:

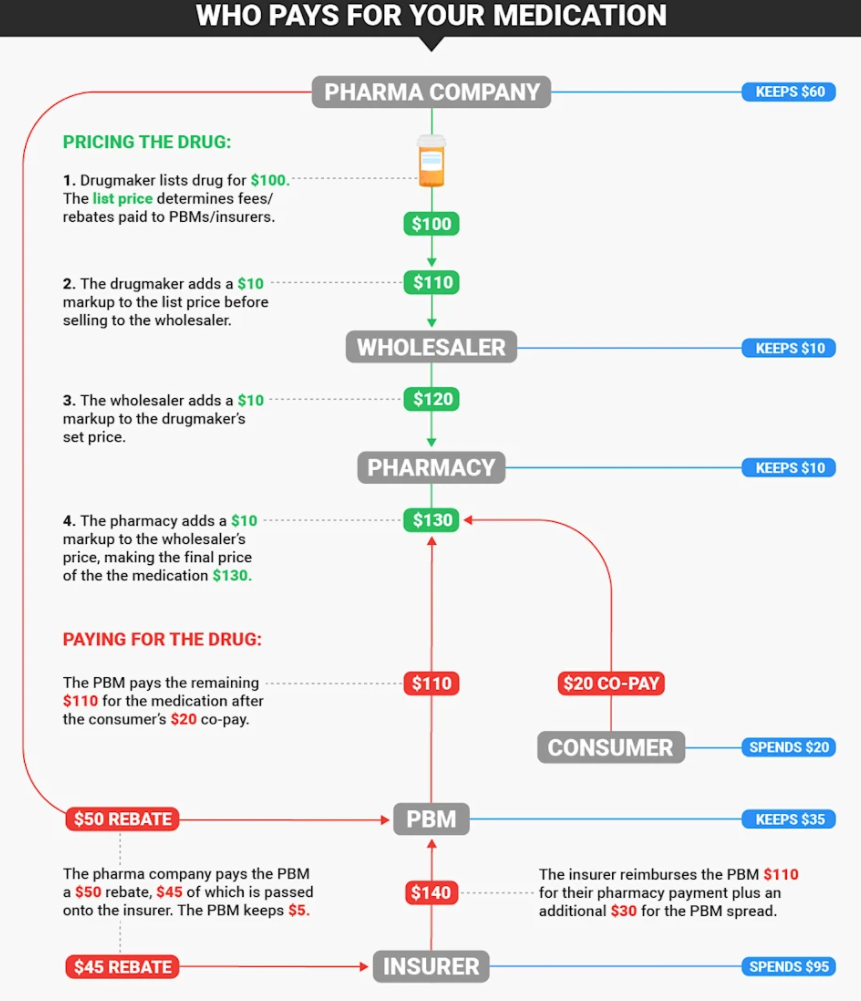

Understanding The Slight But Important Difference Between Gross & Net Drug Pricing

A drug’s gross price = list price that a pharma company will advertise. The net price = list price – fees, discounts, and rebates. So, the net price is what the pharma company actually keeps, after all the middlemen in the US healthcare system have taken their cut. The much more relevant figure, when it comes to criticizing big pharma, is the net price.

The middlemen in drug pricing add markups to the drugs price, as well as take rebates from the gross price for their own bottom line. These middlemen are primarily wholesalers and pharmacy benefit managers (PMB). Discussing the inefficiencies and added costs are beyond the scope of this article and require an overhaul of the US healthcare system.

For those interested, below is an explanation of how medication is paid for in the USA.

Figure 3:

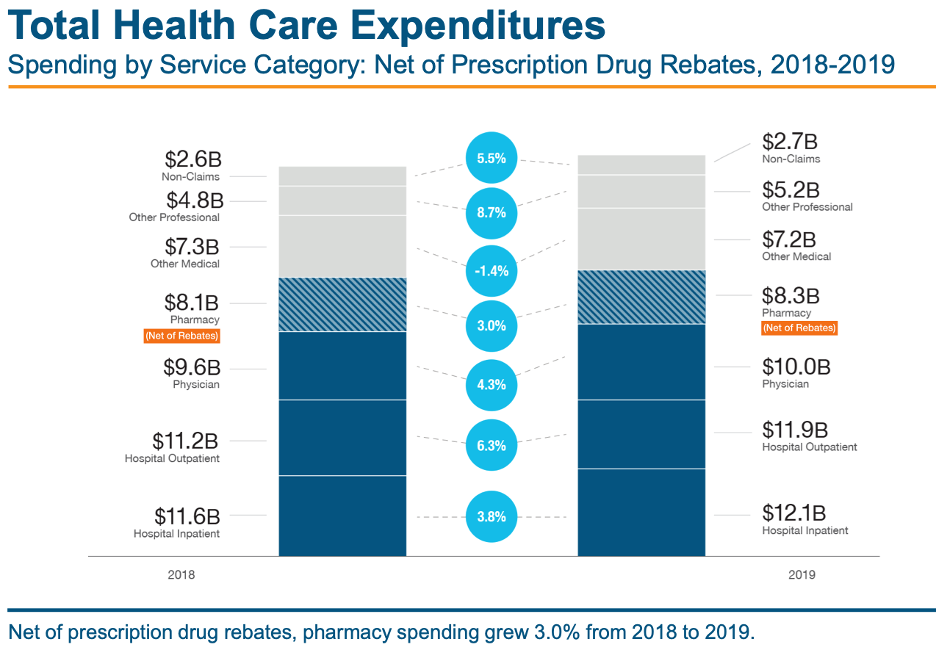

Going back to the Massachusetts presentation: another slide of the presentation shows that net prescription drug rebates are only growing at 3%. So, the net drug spending growth is lower than almost every other aspect of healthcare spending. The 3% net growth figure is significantly lower than the 7.2% gross figure and doesn’t actually paint pharmaceutical companies as evil price gauging corporations.

Figure 4:

Reality: Prescription Drugs Grew 3%

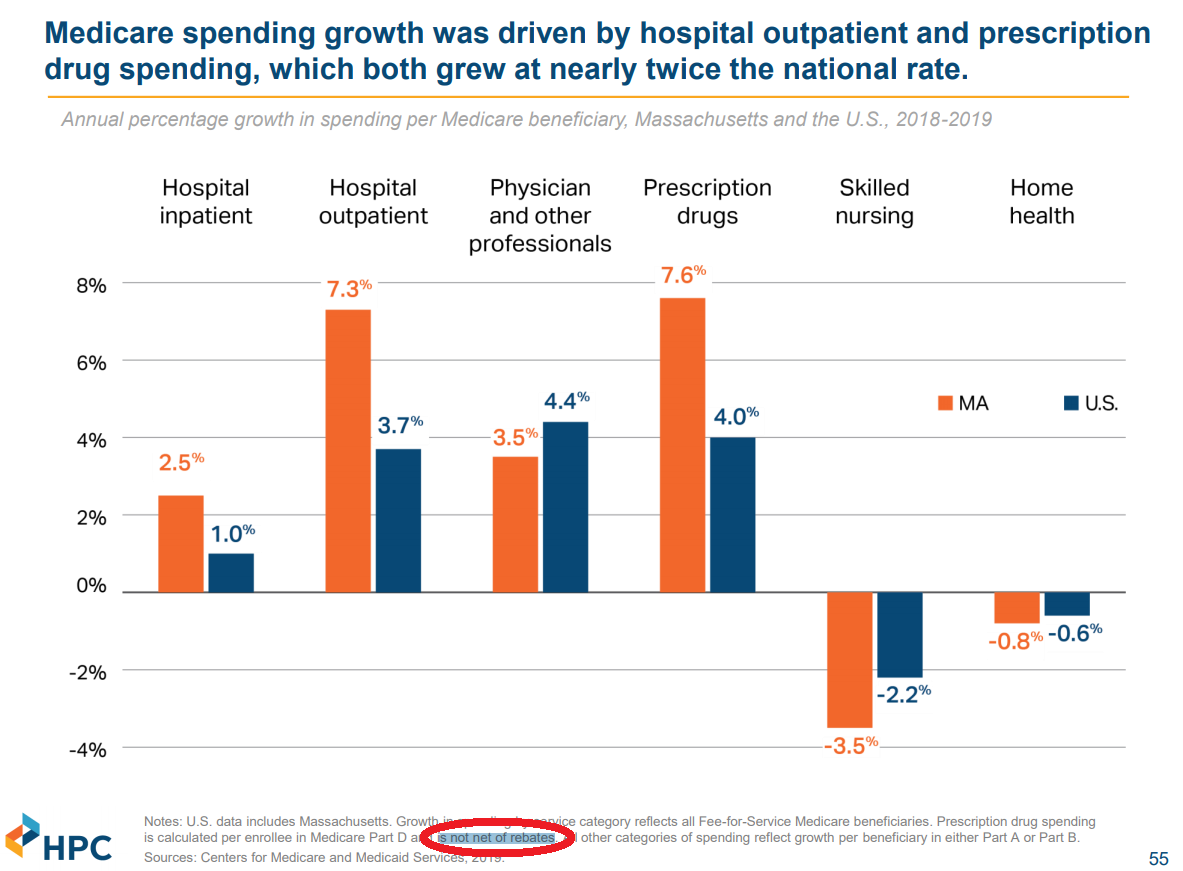

This reality, however, does not align with political campaigns. Someone has to fall on the sword, and in this case, it is pharmaceutical companies. Another slide in the Massachusetts presentation (image below) claims that drug prices have the highest growth and are to blame for increased Medicare spending. However, if you take a closer look at the fine print, it says that prescription drug spending is “not net of rebates”.

Remember, net pricing is what pharmaceutical companies actually keep. The rebates are what the middlemen (wholesalers/PBMs) take.

Figure 5:

Once net rebates are considered, the narrative of healthcare spending changes dramatically and the growth of drug prices are actually reasonable. Though the data above shows that hospital spending has greatly increased, the focus of the Massachusetts presentation is on painting drug pricing as an out-of-control cost. This is misleading and deceiving.

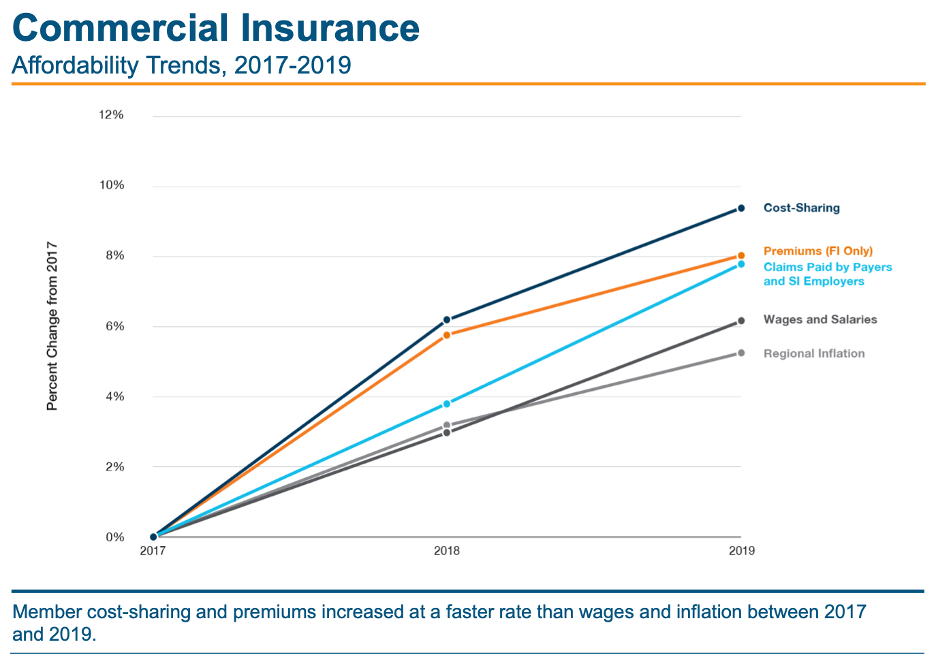

What should have been highlighted is the increase in insurance premiums compared to wages (image below). Wage growth (6%) is falling behind health insurance premium growth (8%). This leads to rising out of pocket (OOP) costs for patients and less affordability.

Where is Rise of Healthcare Cost Coming From?

Given the data shown in this presentation, one might ask; if not from drug prices, where are these increases in healthcare prices coming from? The answer is hospital outpatient. As shown in Figures 2,4,5 above, hospital outpatient growth is 7.3%.

The outpatient department is the part of a hospital designed for those who visit the hospital but do not require a bed. Think of outpatient as same day services, diagnostic tests, and minor surgical procedures.

The Political Solution Will Limit Innovation & Destroy Value

To solve the misdiagnosed “drug pricing” issue, politicians are contemplating placing pricing limits on pharmaceutical products. This will ultimately hinder innovation and have adverse repercussions on the healthcare system.

It is important to understand how drug discovery and development works. Drug development, from start to finish, takes on average of 10 years. Pharma companies invest around $1 billion dollars to study the drug and get it through the FDA approval process. During this decade long journey, the companies do not make any revenues from the drug. They start seeing a return on their investment when the drug makes it to market.

Limits on drug pricing creates a smaller reward and diminishes the incentive system for drug investment. This results in less innovation and drug development. Ultimately, the ripple effect will spread to greater hospitalizations.

Drugs, in many cases prevent people from being hospitalized which saves overall healthcare costs. If US officials decide to put price controls on pharma, this will halt innovation. Rather than putting the blame on pharma, who formulate drugs to help keep patients out of hospitals, a more efficient solution would be to make sure all drugs become generic. They meet the same requirements in regard to quality and efficacy, at a fraction of the cost of brand name.

Though the data above shows that hospital spending has greatly increased, the political focus remains on prescription drugs. While drugs do make up 10% of healthcare spending, they are not solely responsible for the dramatic increases. When net prescriptions, rather than gross are taken into account, drug pricing is actually not to blame. It is time politicians start prioritizing the data over their political agenda.